Better decisions with project portfolios

Decisions on project investments are usually influenced by various factors. In many cases, however, companies do not follow a structured decision-making process. Instead, steering committees or other committees make decisions on projects on the basis of assumptions, some of which contain high risks for the company. Here there are sensible considerations and instruments with which such decisions can be meaningfully supported. I would like to present some of them here.

Definition of project portfolio management

In “The Standard for Portfolio Management”, by the Project Management Institute (PMI), 4th edition 2017, the following definition can be read: “Portfolio management is the centralised management of one or more portfolios to achieve strategic objectives.”.

Here, portfolio is understood to be a collection of projects, whereby projects with the same or similar objectives are also grouped together as programmes. A portfolio thus usually consists mainly of programmes and some individual projects, depending on the structure of the company and its customers. Operations – i.e. the business – is remarkably also part of the portfolio and thus makes it possible to recognise conflicts of resources that are responsible for operations in addition to project work.

Which project will win the race?

The “Centralised Management” mentioned in the definition is closely related to so-called PMOs, i.e. Project Management Offices. A PMO is typically responsible for project management standards, templates and methods in the company, and in some cases is also the “home” of the project managers. In this case, the PMO has a team of PMs, a PM is assigned to each new project. However, the question now remains open: “Which project will win the race?

How does a company come to decisions for or against projects? In practice, such decisions are usually not made by the PMO itself, but by another body made up of senior managers and the executive board. Some typical and useful factors influencing portfolio decisions are (in alphabetical order)

- feasibility

- profitability

- resources

- risks

- strategy contribution

- time

Also typical, but not always useful, are e.g. the following factors, often not obvious (hidden)

- taste, preferences

- personal advantages

- preferences for suppliers

- state of the art

All factors are deliberately listed alphabetically so as not to give the appearance of a priority. So what factors are used to make a decision? This is a question that every company has to answer for itself; there are no clear standards or weightings. However, it is important that a company defines these factors very consciously and clearly. If unspoken factors such as personal preferences or “technophilia” play a role, or opportunism or power games arise between camps or stakeholders, decisions become distorted and irrational. In the standard literature on project and portfolio management, the factors of the first group are always cited; they are certainly indispensable in most organisations.

Feasibility

Feasibility has many aspects. The first is perhaps the technical and financial feasibility, but acceptance by employees, customers, suppliers and society in general also plays a role. Certain things are not feasible because they do not fit into the value system of a society or because they would simply not be accepted in a company. Certain things are not done. There are hard limits to what is feasible in the case of laws, where hardly any discussions or differences of opinion arise, because laws must be observed. In the area of data protection, there are particularly good examples of situations that are not precisely regulated by law, and here there are considerable differences in different companies or countries. The never-ending discussion about the handling of data on Facebook is a very popular and current example.

Profitability

Every project investment must be profitable, full stop. This statement provokes contradiction, because everyone will have experienced projects that have not generated profit, or perhaps even damage. But there are exceptions, because for example the implementation of regulatory requirements in projects can be necessary to prevent damage to the company. If a company does not comply with the regulatory requirements, penalties, conditions and, in the worst case, the withdrawal of the licence or closure are the result.

The – let’s call them – regular projects, which are carried out with the intention of achieving a positive profitability, should have a value proposition with a business case, i.e. a comprehensible value proposition with a profitability forecast. Financial mathematical ratios such as ROI, NPV and IRR are common.

Return on Investment (ROI): return on sales * capital turnover = profit / net turnover * net turnover / investment, indicated in %, the higher the better!

Net Present Value (NPV): Sum of the present values of all payments (incoming and outgoing) caused by this investment NPV = proceeds – investments, summed up for n periods. The higher the better!

Internal Rate of Return (IRR): The internal rate of return is the interest rate that results in a zero net present value when discounting surpluses, expressed as a percentage. The higher the better, the higher the rate of return should be at least as high as the rate of return that could be achieved with an alternative investment. It cannot be calculated analytically, but only approximately, e.g. numerically with the Regula Falsi method.

As a general rule, projects should have an NPV greater than zero, otherwise the project as a whole means a loss. This ratio is usually present in projects and is easy to understand, because if the revenue from a project is greater than the investment, the project is a good candidate for implementation in the first place. The IRR and ROI indicators are used to describe the performance of an investment in a project. Unlike ROI, IRR also takes into account the future value of the investment. IRR is also known as the internal rate of return and provides perhaps the most accurate statement about a project, but it is also more difficult to calculate than the other indicators and much less descriptive. ROI, Return On Investment, is very popular and shows very clearly the percentage return of a project in a period of time to be determined.

Which key figures are used in the company varies. Three key figures are not always necessary and pragmatic, especially not for small, shorter projects and also not for particularly low interest rates when raising capital, as they have been available in some cases in recent years. From my project experience, I can report that a simple, clear and quick to grasp profitability forecast can greatly accelerate decisions. If the business case is too complicated or too vague, the project will not be approved at first or you will need many explanations and several attempts at the decision-making body.

Resources

Several projects in companies are basically competing with each other; it is a question of resources, budget and the time that employees devote to the project. Financial resources can be used to compensate for human resources under certain circumstances by bringing in external staff to the projects. However, if the know-how or networking of internal employees is required for the success of the project, external sourcing is only of limited use. In portfolio management, therefore, the factors of feasibility and resources are closely linked, as certain projects are only feasible if internal staff are sufficiently involved. If necessary, the factors must be adapted to the company’s situation and further broken down to enable a selective evaluation. This is shown below in the exemplary evaluation matrix in the context of balancing.

Risks

Risks play a major role in project portfolio management, because risky projects can cause a lot of damage on the one hand, but on the other hand also offer opportunities for large profits. In the context of project evaluation, however, in common parlance only those risks are usually referred to as those that can cause damage, also called negative risks. The positive risks, also called opportunities, on the other hand, are shown as potential profits in the profitability forecast.

In this respect, the principle that it is better to take the path of lower risk applies to portfolio management, just as it does in everyday life; otherwise, two alternatives have the same factors. Reducing risk has an impact on investments, because reducing the probability of occurrence and the maximum loss usually costs resources. Reducing the risks in proposed projects to a level acceptable to the company through appropriate measures may make them uneconomic. The big challenge here too is therefore the balancing of the factors.

Strategy contribution

Each project should of course contribute to the strategy, but for very small projects this factor may not be necessary. Normal and large projects with no or little strategy contribution will only be implemented if there are other good reasons. These reasons can be, for example, expiring support for a business application, so that an upgrade or change is inevitable. Potentially particularly profitable projects can also be so attractive that the strategy contribution loses significance.

Time

The duration of a project or the time until the go-to-market plays a particularly important role in projects that bring new products to market as results. The timing of a product launch can decide on success or failure. Often the official date of the end of the project is set and everything is geared to it; postponing the date is considered a failure. This often leads to compromises in the quality of the end product, and thus quickly leads to the failure of the entire project. In this respect the time factor is important and in some cases – in the case of new products for the market – also decisive, but a fundamental subordination of all other factors to meeting the deadline seems unreasonable.

Balancing the factors – what is worth how much?

Balancing the factors is very difficult and is also the core task of portfolio management. How can the various factors in several programmes and projects be evaluated so that the overall risk for the company is as low as possible and the proceeds are as high as possible while at the same time contributing to the corporate strategy? More simply put, how is it decided in which project to invest?

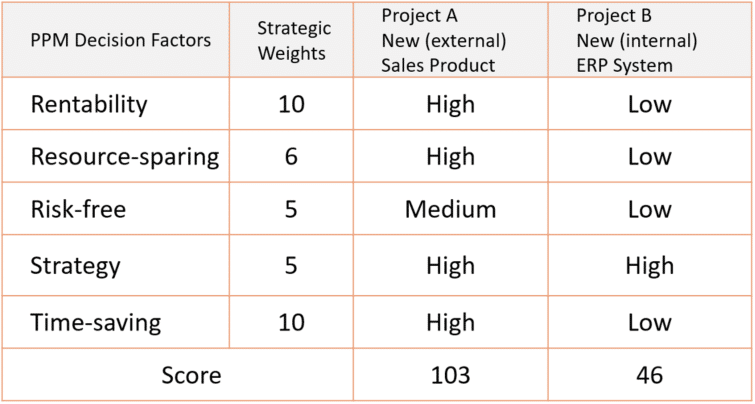

First of all – as already mentioned – it is essential that a company defines the factors, clearly discloses and describes them and sets the priorities of the factors among themselves. This leads to the very valuable side-effect that the company’s strategy is critically reflected and, if necessary, more precisely described, adjusted and clearly communicated. The disclosure of the factors and the strategy leads to transparent decisions being made in portfolio management and project management for all employees. This increases the effectiveness and motivation of the team. The following table shows an example of how a company relates the factors for two competing projects. While profit and time play the biggest role, factors such as the strategic contribution and risks are rather subordinate. Conflicts that arise when deciding on one or the other project can be solved more easily with the help of the list of dissected factors. Hidden factors, “hidden agendas”, lose influence because they do not appear in the evaluation system.

Simplified decision matrix for two competing projects

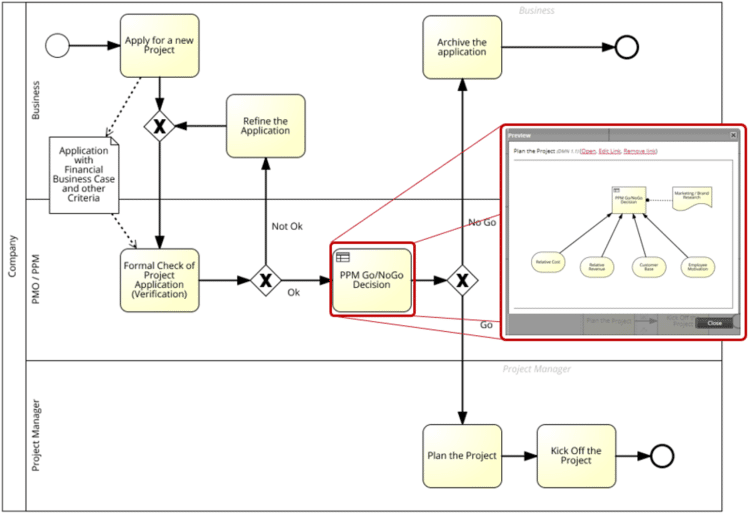

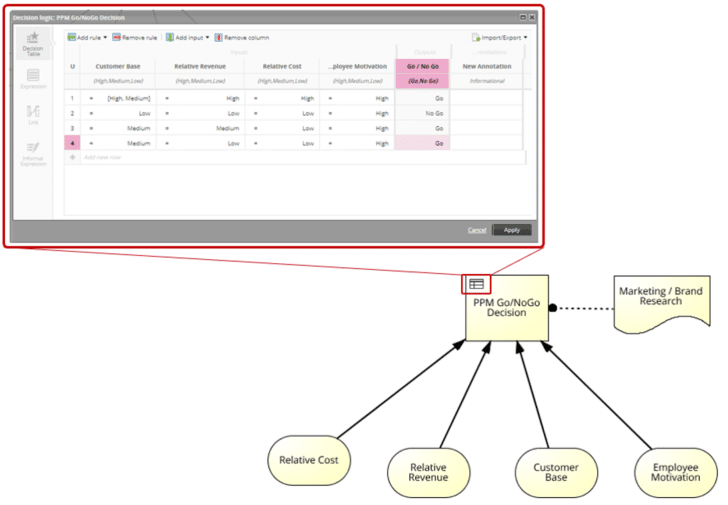

Formalising decisions through processes and rules

If a company reaches agreement on the factors and their priorities, the installation of a business process for portfolio decisions is recommended. In order to make the business process easily comprehensible for all employees, a visual BPMN model (Business Process Modelling and Notation) that is as simple as possible is advisable. However, the rules for an evaluation and a recommendation for a decision quickly become complicated. A BPMN model of the above mentioned decision matrix would hardly be communicable to the people involved and thus be useless. A remedy is provided by another modelling language especially for decisions: Decision Modelling Notation (DMN). DMN allows the structured description of decision factors and considerably reduces the complexity in a BPMN model. Models constructed in this way are easy to understand and thus offer orientation and traceability of decisions to all participants.

BPMN business process in portfolio management with embedded DMN model

DMN model with decision factors or business rules

Conclusion

Balancing programmes and projects is the core task of project portfolio management. Important and far-reaching decisions have to be taken to achieve this. These decisions should be based on rational, clearly understandable factors and be comprehensible to all those involved. This can be achieved through uncompromising transparency. To this end, the business process and the decision factors in portfolio management must be comprehensible and documented and accessible to all those involved. Then the rational factors win and lead to reasonable decisions, the not reasonable factors lose more and more importance. The prerequisite is, of course, that everyone in the company accepts the processes and rules, including the management.

Notes:

Under the direction of Mr. Wendt, masVenta Business GmbH organizes an annual conference for business analysis and requirements engineering, the European Business Analysis Day, in short BA-DAY. In contrast to other conference formats in these fields, this event is consistently international in scope and offers many opportunities for networking with the international BA and RE community in addition to presentations by excellent speakers from all over Europe, America and Canada.

Rainer Wendt has published two more articles in the t2informatik Blog:

Rainer Wendt

Rainer Wendt, CBAP, PMP, PMI-PBA, PMI-ACP, well-known trainer and expert for business analysis, project management and agile approaches, is always focused on the sustainable benefit and profitability of projects. He is convinced that the business analyst and the project manager are jointly responsible for this. As managing director and himself an active consultant of masVenta Business GmbH (www.masventa.de), he has accompanied many projects in various industries. Rainer Wendt is also acting president of the German chapter of the International Institute for Business Analysis (IIBA).

In the t2informatik Blog, we publish articles for people in organisations. For these people, we develop and modernise software. Pragmatic. ✔️ Personal. ✔️ Professional. ✔️ Click here to find out more.